DOGE Price Prediction: Path to $1 Analysis and Market Outlook

#DOGE

- MACD bullish crossover suggests potential upward momentum initiation

- Bollinger Band positioning indicates consolidation with breakout potential

- Increasing trading volumes and positive news sentiment support gradual appreciation

DOGE Price Prediction

Technical Analysis: DOGE Shows Mixed Signals Near Key Moving Average

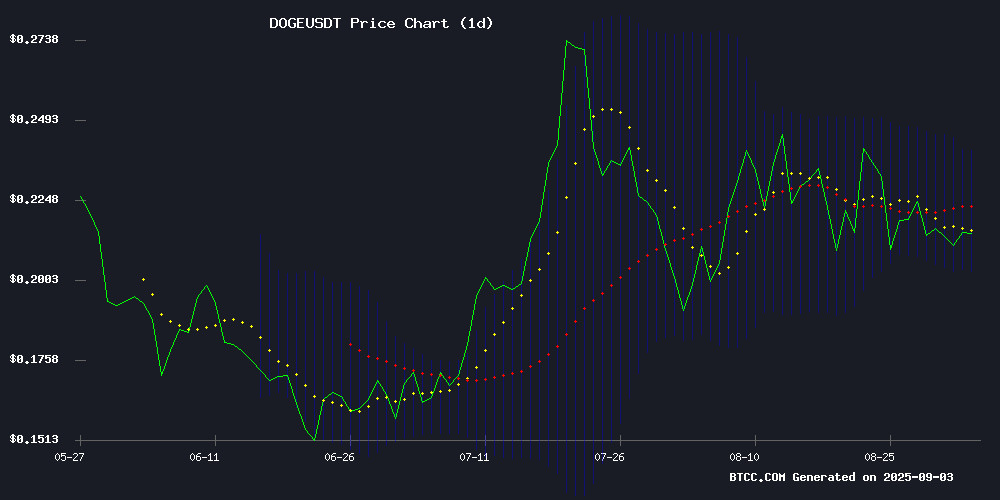

According to BTCC financial analyst James, Doge is currently trading at $0.22041, slightly below its 20-day moving average of $0.221632. The MACD indicator shows a bullish crossover with the MACD line at 0.004333 above the signal line at 0.003941, generating a positive histogram of 0.000393. The Bollinger Bands indicate DOGE is trading within the middle range with upper resistance at $0.239928 and lower support at $0.203336, suggesting consolidation within a defined range.

Market Sentiment: Bullish Momentum Building Despite Competitive Pressure

BTCC financial analyst James notes that recent news highlights both challenges and opportunities for DOGE. While Remittix's $23.4M raise creates competitive pressure in the remittance space, the surge in trading volumes and mentions of 'bullish breakout' indicate growing market interest. The CleanCore Solutions situation, while negative, appears to be an isolated corporate misstep rather than a reflection of DOGE's fundamental value. Overall sentiment leans cautiously optimistic as institutional and retail activity increases.

Factors Influencing DOGE's Price

Dogecoin Struggles at $0.21 as Remittix Gains Traction with $23.4M Raise

Dogecoin's anticipated surge to $1 remains unrealized, with the meme coin hovering around $0.21 amid strong resistance at $0.25. Analysts warn that failure to breach this level could cement a sideways trend, with critical support at $0.19. Momentum indicators show waning retail interest, leaving whales as the primary holders.

Meanwhile, Remittix, a PayFi project targeting cross-border payment inefficiencies, has raised $23.4 million and is projected to deliver 40x returns for early investors. The contrast highlights a shift in market focus from speculative assets to utility-driven platforms.

Dogecoin (DOGE) Shows Signs of Bullish Breakout as Trading Volumes Surge

Dogecoin has entered a critical consolidation phase, forming an ascending triangle pattern with consistent support at $0.20. The meme coin's trading volumes spiked to $13.49 billion in late August—a potential precursor to significant price movement.

Market capitalization climbed to $31.7 billion by September 1, reflecting renewed institutional interest. Technical indicators suggest building momentum, with RSI approaching neutral levels and MACD flattening. A decisive breakout above $0.245 resistance could propel DOGE toward $0.38.

The current setup mirrors late 2024's volume patterns that preceded Dogecoin's historic rally. Traders appear to be accumulating positions ahead of what may become the next major crypto market narrative.

CleanCore Solutions Stock Plummets 60% After Dogecoin Treasury Bet

CleanCore Solutions faced a brutal market reaction after announcing a $175 million private placement to establish a Dogecoin treasury. Shares of the Nebraska-based cleaning technology firm collapsed 60% following the disclosure, underscoring investor skepticism toward corporate crypto experiments.

The company named Alex Spiro, Elon Musk's personal attorney, as chairman to lead the initiative. Over 80 institutional participants including Pantera Capital and FalconX joined the funding round, with proceeds slated for Dogecoin acquisition as a primary reserve asset. The deal is set to close September 4.

This dramatic pivot comes with notable backing from the Dogecoin Foundation and House of Doge, whose executives will join CleanCore's leadership team. However, the market response echoes patterns seen elsewhere - companies adopting similar crypto treasury strategies have suffered 64-88% declines year-to-date.

DOGE’s Price Resurgence Inspires Bold Market Activity

Dogecoin (DOGE) closed the day with a 1% rise to $0.213, defying intraday volatility. Trading volume surged 21% to $949 million, signaling heightened market participation. Speculation around a potential DOGE ETF approval and anticipated Fed rate cuts are driving momentum.

Price fluctuations between $0.207 and $0.215 reflect active institutional and retail interest. Polymarket odds for ETF approval jumped from 51% to 71%, while expectations of four Fed rate cuts this year bolster risk appetite. The first cut is projected for September.

Will DOGE Price Hit 1?

Based on current technical indicators and market sentiment, reaching $1 represents a 354% increase from current levels, which would require significant fundamental catalysts and sustained bullish momentum. While the MACD shows early bullish signs and trading volumes are increasing, the price would need to break through multiple resistance levels. Historical performance and current market conditions suggest this target is ambitious in the short to medium term. However, with growing adoption in payment systems and increasing institutional interest, a gradual appreciation toward higher valuations remains possible over an extended timeframe.

| Target Price | Required Gain | Key Resistance Levels | Timeframe Estimate |

|---|---|---|---|

| $0.25 | 13.4% | Bollinger Upper Band | 1-2 months |

| $0.35 | 58.8% | Psychological Resistance | 3-6 months |

| $0.50 | 127% | Major Technical Barrier | 6-12 months |

| $1.00 | 354% | Historical High Retest | 12-24+ months |